Phil Cannella made a huge splash in Washington

after interviewing the Inspector General of the SEC.

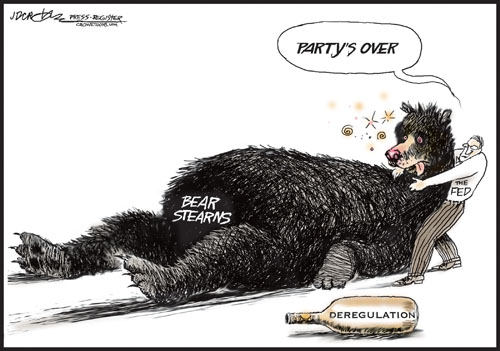

Former SEC Inspector General H. David Kotz had a reputation for demanding aggressive action from the SEC’s enforcement division against financial firms who engage in unethical or illegal activities. Kotz’s tenure at the Office of Inspector General has been marked by tough investigations into the SEC’s enforcement against unethical trading practices. One such investigation occurred when a probe into the activities of the now defunct financial giant Bear Stearns was unexpectedly dropped. In 2005, the SEC investigated allegations that Bear Stearns fraudulently priced mortgage-related investments, a move which may have caused the firm’s failure. The SEC did not bring charges against Bear Stearns, which, when the firm folded, brought into question the Commission’s ability to enforce its laws against unethical practices.

In his interview with Phil Cannella, host of The Crash Proof Retirement Show™, Kotz believes the SEC had prior knowledge of illegal activities at Bear Stearns when it dropped its investigation. Kotz admitted to Phil Cannella, “One of the things we did find though, in our Bear Stearns report was that there were red flags within the SEC about Bear Stearns’ concentration of subprime exposure. . . .That there were troubling issues and that not enough action was taken.” Kotz felt the SEC could have been more aggressive in this matter, and could have possibly prevented the failure of Bear Stearns altogether. Kotz also stated in the interview with Phil Cannella that, “[The SEC] need[s] to look carefully at entities like, in that case investment banks, and take appropriate, aggressive action. The SEC needs to undertake aggressive oversight and I think if they undertake aggressive oversight, they may be able to help with some of these meltdowns.”

In his interview with Phil Cannella, host of The Crash Proof Retirement Show™, Kotz believes the SEC had prior knowledge of illegal activities at Bear Stearns when it dropped its investigation. Kotz admitted to Phil Cannella, “One of the things we did find though, in our Bear Stearns report was that there were red flags within the SEC about Bear Stearns’ concentration of subprime exposure. . . .That there were troubling issues and that not enough action was taken.” Kotz felt the SEC could have been more aggressive in this matter, and could have possibly prevented the failure of Bear Stearns altogether. Kotz also stated in the interview with Phil Cannella that, “[The SEC] need[s] to look carefully at entities like, in that case investment banks, and take appropriate, aggressive action. The SEC needs to undertake aggressive oversight and I think if they undertake aggressive oversight, they may be able to help with some of these meltdowns.”

When Kotz issued his report about the Bear Stearns investigation, the SEC’s Division of Trading and Markets requested deletions of any references to SEC memos, meetings, and comments relating to the matter. In a letter addressed to Kotz, Senator Charles Grassley of Iowa commented on the SEC’s failure to investigate, saying, “People can judge for themselves, but it sure looks like the SEC didn’t want the public to know about the red flags it apparently ignored in allowing Bear Stearns and other investment banks to engage in excessively risky behavior.” John Nester, spokesman for the SEC, said the deletions from the Inspector General’s report were made because it contained “non-public information.” The SEC may have been justified in deleting this material, but without an official record of what exactly was deleted, no one will ever know. And with the SEC’s history of destroying documents relating to “matters under investigation,” it is probable that they covered up red flags in other investigations over the years.

FOR MORE INFORMATION FROM PHIL CANNELLA, TUNE IN TO THE CPR SHOW, EVERY SATURDAY 11AM